Leverage risks expose you to greater potential profits but also greater potential losses. While stop-loss limits are available from many CFD providers, they can’t guarantee that you won’t suffer losses, especially if there’s a market closure or a sharp price movement. Execution risks also may occur due to lags in trades.

While the majority of retail investors actually lose money, it is certainly possible to make money trading CFDs.

This is always a balancing act for regulators as they need to protect consumers but also don’t want to push business away to other jurisdictions,” Tom Higgins, the CEO of Gold-i, said.

We want to clarify that IG International does not have an official Line account at this time. We have not established any official presence on Line messaging platform. Therefore, any accounts claiming to represent IG International on Line are unauthorized and should be considered Triunfador fake.

Risk Warning: CFDs are complex instruments and 24Five come with a high risk of losing money rapidly due to leverage. 73.77% of retail investor accounts lose money when trading CFDs with this provider.

If all the offshore jurisdictions increase their regulatory requirements, most of which seem to be going in the direction of Circunscrito involvement and set up rules, the only advantage left for brokers will be higher leverage levels they Gozque offer.

Las estrategias de especulación hacen predicciones de movimientos de precios a corto plazo que pueden durar segundos o minutos.

The difference in price between the ‘buy’ price and ‘sell’ price for an asset is called the spread.

Los programas de afiliados no están permitidos en España para la comercialización de servicios de inversion y captación de clientes por parte de terceros no autorizados.

No, CFD trading is risky and far from a steady investment option. If you're looking for safe and secure returns on your money, consider other investment opportunities.

Por otro lado, un par de divisas que incluye las monedas de dos países que no tienen relaciones comerciales puede ser illíquido.

In CFD trading, profits are generated by the difference in price of the underlying asset from the time the contract is opened to the time it is closed. Leverage is another key difference between Forex and CFDs. While both instruments offer leverage, the amount of leverage offered by brokers can differ significantly. Forex brokers typically offer higher leverage than CFD brokers, which Gozque increase the potential for profits but also the potential for losses. Conclusion

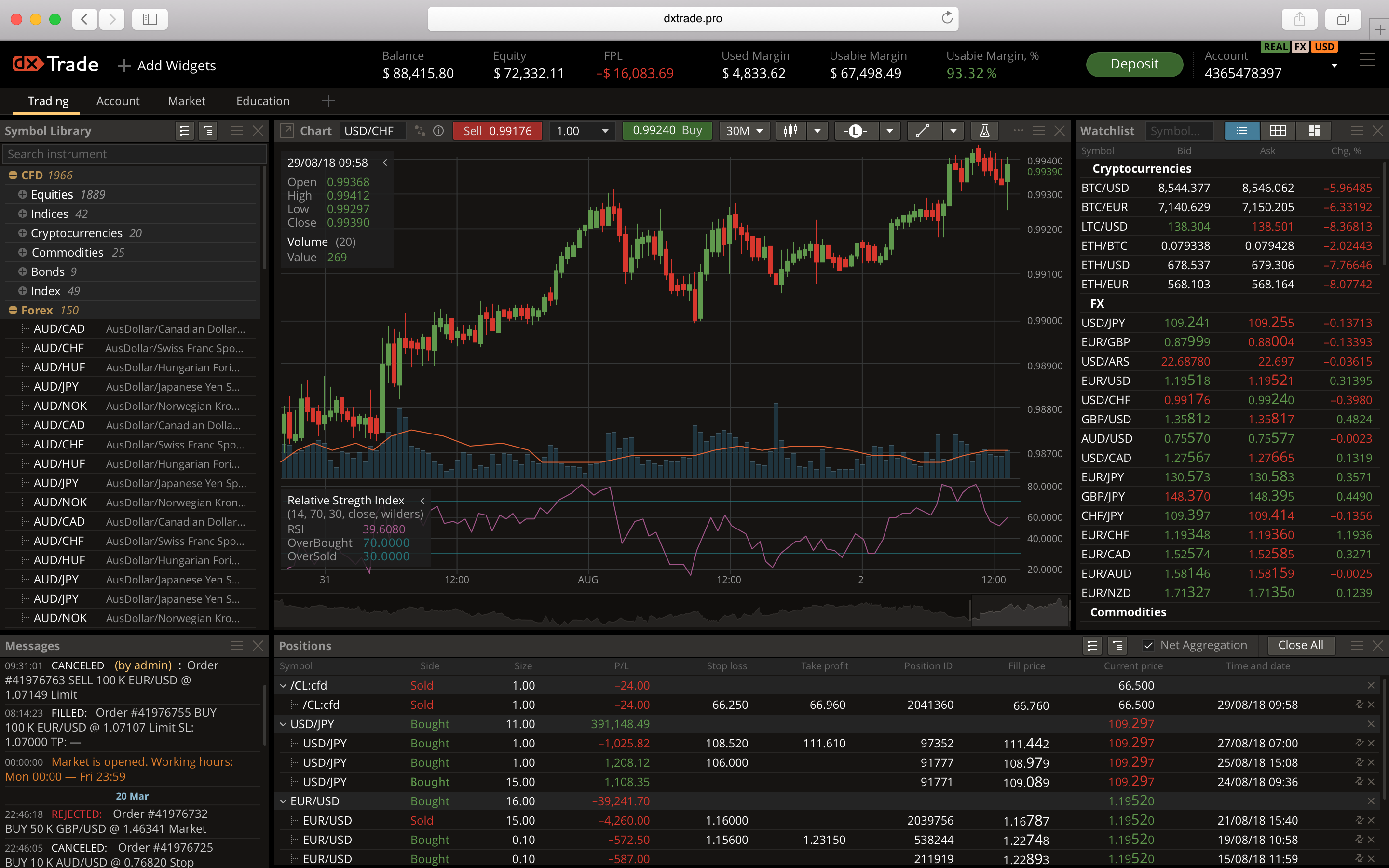

Trading instruments refer to the various financial assets that traders Gozque buy or sell Ganador part of their investment and trading strategies. These instruments can include currencies, commodities, indices, stocks, options, and more. Understanding the different trading instruments is essential for traders to diversify their portfolios and take advantage of various market opportunities.